Five operational recommendations to support the execution of your mergers and acquisitions strategy

In our previous interview blog-post we described some acquisition strategy trends in the consulting industry. But now, as we all know, a strategy is practically useless without right execution. Therefore, based on our findings from interviews with 34 respondents active in the consulting industry, we suggest five operational recommendations that will support you as an acquirer to make better decisions and develop the right process capabilities.

Evaluate opportunities with speed and precision

Proper investments always start with a strong investment rationale and thorough due diligence. Our findings puth emphasis on operational due-diligence. Try to evaluate how the target company truly operates and what are the benefits and associated risks. In other words, how the two organisations will fit together. But do not analyse the case for too long, because then you might miss the opportunity. Therefore, we suggest that you establish a clear screening funnel with criterias based on your corporate strategy and be prepared with the necessary resources and time to everyone involved, to be able to act with speed, quality and precision when opportunities arise.

Honesty and Transparency to Build Trust

As you sit down with the potential target, be open and talk about success factors, expectations and potential problems. It is important that you don’t promise things you cannot keep. Our findings highlighted that honesty, trust and shared vision is essential for sustainable relationships and partnerships. Also, try to clearly understand the motivation why the previous owners want to sell the company, to prepare and plan the post-deal actions accordingly. Just as you view partnerships, build the M&A relationships on mutual trust and long term commitment, to create a sense of togetherness and that you are in this together.

Change Awareness

To ensure that the talents do not leave out the door, make sure to acknowledge people’s subjective opinions and feelings. As you might have experienced in your career, people feel anxiety and insecurity when they are facing new changes. Aim for a post-deal situation that is better for everyone involved and be aware of the potential changes. The changes can be both tangible like office location and salaries, as well as intangible like brand prestige and company culture. The potential changes implies for both acquirer and target company . People want to feel that their situation is getting better, not worse, and remember, this is highly subjective, so you have to try to see it from their point of view.

Involve for commitment

We recommend that you involve internal leaders and affected business unit managers in the pre-deal decision-making to facilitate organisation-wide commitment for the entire acquisition process. With a sense of belonging, these leaders can be a key player in creating an engaging and transparent culture that drives the future integration. Additionally, to cope with the previously mentioned growing anxiety and insecurity, strive for openness and transparency on why and how things are proceeding. The answer is not to involve every employee in the pre-deal decision-making, but rather to have a clear communication plan to convey the message right and clearly.

Dedicated M&A Team

Not everyone has M&A experience; therefore, our findings showed that it is useful to have a dedicated M&A team in place with clearly defined roles and responsibilities to manage the complicated process and support internal leaders and new employees. Use the dedicated M&A team as a supportive function, rather than a separate unit taking all the M&A related decisions, since it is crucial with local attachment to create ownership and responsibility. Additionally, the M&A team helps to bundle and capture all M&A related knowledge and experience within the firm from the previous acquisitions to develop the capabilities to manage the forthcoming ones.

For many companies, M&A is a tool, and like any other tool, needs the right execution in order to be successful. We hope these five operational guidelines will support you as an acquirer to make better decisions and improve the odds of long-term success.

Read the full report here.

Guest Bloggers - Oscar Johansson and Emil Segerlund, Master students at Chalmers University of Technology

Guest Bloggers - Oscar Johansson and Emil Segerlund, Master students at Chalmers University of Technology

You may also like...

All posts

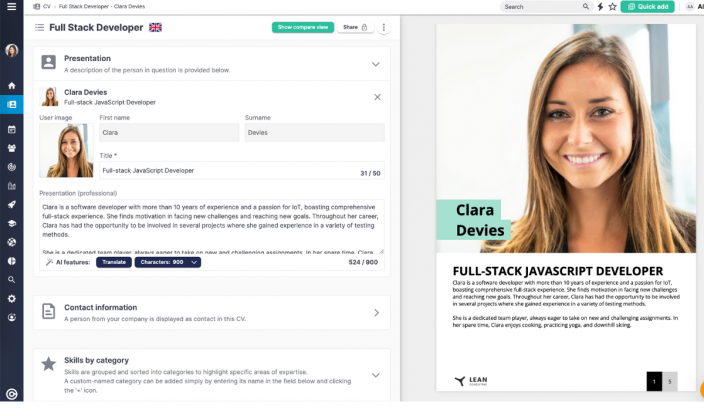

Apr 09 2024 · Cinode, Consulting

Your Consultant Resume on Autopilot with AI Support

Mar 28 2024 · Consulting

6 Easter Eggs to improve your Consultancy

Mar 26 2024 · Cinode, Consulting

8 Important Reasons to Expand Your Network of Subcontractors and Partners – And How to Do It!

Mar 19 2024 · Consulting

The hybrid consultant creates greater value for the customers, themselves, and the consulting company

Mar 12 2024 · Consulting

Soon we all have to become hybrid consultants

Feb 08 2024 · Consulting, Entrepreneurship

The advantages of digitizing your consulting process

Jan 31 2024 · Consulting, Entrepreneurship

Are you swimming in the red or blue ocean? Dominate your market through a “Blue Ocean” strategy

Jan 25 2024 · Consulting

How to Reduce Bench Time in Your Consulting Firm

Dec 06 2023 · Consulting, Entrepreneurship

AI – an impending shift within the junior consulting profession

Nov 23 2023 · Consulting, Entrepreneurship

Being kind at work pays off

Nov 08 2023 · Consulting, Reference case

Redeploy Group expands the offer with data and AI services and aims for Nordic expansion

Oct 31 2023 · Consulting