Bridging the gap between Swedish companies and Polish IT talent

In the heart of Europe, a transformation is taking place. Once overlooked, Poland has been emerging as a preferred IT outsourcing destination for global players and now also for Swedish companies. A change driven by a blend of high-quality services, cost-effectiveness, and a similar work culture. But this shift isn’t just about economics. It reflects the influence of globalisation and technological advancement on traditional business structures.

Behind this evolving partnership, two companies, Cinode and H2B Sverige, play a vital role in bridging the gap between Swedish companies and Polish IT talent. So join us as we explore Poland’s rise in the IT world in the upcoming two articles and what it means for the future of Swedish business in the digital era.

H2B Sverige is an exciting Swedish (Stockholm) offshoot of a Polish parent company, with HQ in the lively city of Gdansk and offices in Warsaw and Tallinn. We offer a whole host of outsourcing services, from staff augmentation and team building to business and tech consulting. One of our standout services is the CTO-as-a-Service consultation, where we share our tech insights and expertise to drive customer success.

Connect customers with an extensive network

As a cross-border broker, having offices in both Sweden and Poland, which are strategically positioned to serve our Nordic clients in the most effective way. This unique setup means we can connect customers with an extensive network of partners all over Poland, giving them access to thousands of tech professionals who are experts in their field.

At H2B Sverige, our mission is delivering top-quality IT services, promoting innovation, and helping our clients achieve their business goals.

Connecting Polish and Swedish consultants to Swedish customers

Having personally relocated to Sweden in 2018, I’ve spent the intervening years deeply immersed in the outsourcing industry, specializing in connecting Polish and Swedish consultants to Swedish customers and partners and facilitating IT service delivery across the border. Prior to this chapter of my career, I held a position as a Business Manager for Poland’s leading IT Services provider. Currently, I hold the role of CEO at H2B Sverige, a role that empowers me to effectively leverage the decade of experience I have amassed in both these dynamic markets.

Seamless and robust collaboration

I’m continuously fascinated by the untapped potential for symbiotic business relationships between Poland and Sweden. Our ambition extends beyond mere business objectives – we aim to bridge the gap between these two nations, forging a reliable channel for seamless and robust collaboration. The logic of this partnership is self-evident: the Nordic region is in high demand for tech expertise, and Poland – a geographically proximate nation – is increasingly recognized as one of the prime outsourcing destinations for global giants and SMEs alike.

This raises an intriguing question – why hasn’t Sweden fully capitalized on this readily available potential of a partnership with Poland?

The recent development of the Polish consulting market presents an enticing prospect for Swedish companies in search of top-notch consulting services. The compelling reasons include a rapidly growing market, a highly skilled workforce, an innovative ecosystem, and a strong international orientation.

Strong market growth in Poland

Let’s start with the market growth. As of now, the Polish IT market is valued at an impressive $12.87 billion, showing a yearly increase of more than 7 percent since 2020. Furthermore, revenues in the IT outsourcing segment are projected to continually rise between 2023 and 2027. This upward trajectory signifies that the Polish IT market is flourishing and teeming with opportunities for Swedish companies seeking consulting services.

Secondly, Poland boasts the largest pool of IT specialists in Central and Eastern Europe. Polish developers have earned global recognition as top-tier programmers. This rich talent pool, in turn, offers a wealth of knowledge and expertise that Swedish companies can tap into when collaborating with a Polish consulting firm.

A cost advantage does exist due to the lower operational costs in Poland compared to many Western European countries. However, it is not the primary attraction but serves to make an already appealing proposition even more attractive.

Seasoned in collaborating with international clients

Furthermore, Poland presents a broad and vibrant ecosystem of innovative startups, entrepreneurs, and enterprises, augmented by a robust digital infrastructure. Several global corporations have been enticed to shift their operations to Warsaw, Krakow, Katowice, Wroclaw, and other software development outsourcing hub in Poland, pointing to the wealth of innovative ideas and solutions being developed in the country.

Lastly, the Polish IT sector demonstrates a robust international orientation. A significant 34% of half a million IT experts work for companies with Polish capital, while the remaining 66% find employment with foreign organizations. This highlights that Polish consulting firms are seasoned in collaborating with international clients, thereby equipping them with the insights and expertise needed to provide valuable services to Swedish companies.

It’s important to underscore that the potential of Poland’s IT and consulting sector is not just a theory, but in fact, already being capitalized on by many companies worldwide. Industries from technology to banking and finance, healthcare, manufacturing, and retail have recognized the value and are actively outsourcing IT services to Poland. Services ranging from custom software development, web app development, data analytics, automation, and e-commerce solutions are being sought from Polish IT specialists.

Successful IT outsourcing projects in Poland

Perhaps most telling of the ‘Polential’ is the roster of global giants and Nordic businesses that have engaged in successful IT outsourcing projects in Poland. Household names such as Google, Intel, Roche, Amazon, HSBC, Credit Suisse, Motorola, HP, Microsoft, IBM, Cisco, Oracle, Alstom, and Siemens, as well as Nordic powerhouses like Ericsson, Electrolux, Nordea, and TietoEvry have leveraged the Polish IT sector to their advantage.

In essence, the appeal of the Polish consulting market, with its potential for beneficial business relationships, extends beyond mere cost advantages, making it a strategic move for Swedish companies. Notably, many competitors have already begun harnessing the benefits offered by the Polish IT sector, a clear signal that hesitation could risk falling behind in this competitive landscape.

Consulting industries in Sweden and Poland, while diverse, share a set of striking similarities and interesting differences. This dynamic mix gives rise to a unique environment that has the potential for mutually beneficial partnerships.

Balance between professional and personal life

Similarities between the two landscapes include a shared emphasis on work-life balance, a western mindset, English proficiency, European work culture, and smooth communication. Both countries value the balance between professional and personal life, ensuring a work environment that fosters productivity and employee satisfaction. The western mindset that permeates both cultures aligns well with the business practices and communication styles of European and US businesses. In addition, English fluency among Polish professionals and a strong European work culture aid in eliminating potential communication barriers, and enhancing project efficiency.

Differences, while they exist, should not be seen as barriers but as areas that need mutual understanding and adaptation. Despite the common value of work-life balance, Polish employees might work longer hours if needed. Communication styles can differ slightly, with Nordic countries adopting a different style compared to other Western countries. While both countries demonstrate high English proficiency, Nordic countries score higher, potentially leading to misunderstandings if not appropriately managed. Approaches to business practices and time management may also differ, necessitating clear expectations to ensure project success.

Different organisational structures

One major difference, however, lies in the approach to organisational structures. Polish businesses traditionally employ a more hierarchical model with decision-making concentrated at the top levels. This ensures clear lines of responsibility and a strong chain of command. In contrast, Swedish firms favour flat organisational structures that nurture a more inclusive and democratic work environment. The decentralization of decision-making allows for a wider participation and encourages innovation, as ideas can come from any level within the organisation.

Acknowledging these differences, it is crucial to devise strategies to manage potential cultural divergences effectively. Building strong relationships and fostering an understanding of the respective cultures form the cornerstone of successful partnerships. Communication should be clear, concise, and frequent, with realistic deadlines that consider the differing work practices. Emphasizing work-life balance and hiring a local project manager who understands both Nordic and Polish cultures can be significant assets in bridging any cultural gaps.

In summary, cultural differences need not be seen as obstacles but rather as avenues for learning and growth. Both Polish and Swedish companies can benefit from this rich cultural exchange, leading to successful, efficient, and effective IT outsourcing projects.

In the next article, we will write about how to succeed in the Nordic market as a Polish consulting firm with the help of Cinode.

Guest blogger - Jacek Ziółkowski, CEO H2B Sverige

Guest blogger - Jacek Ziółkowski, CEO H2B Sverige

You may also like...

All posts

Oct 10 2025 · Consulting, Entrepreneurship

🚀 The Head of Analysis: Seven Success Factors for Consulting Firms 2025–2030

Feb 08 2024 · Consulting, Entrepreneurship

The advantages of digitizing your consulting process

Jan 31 2024 · Consulting, Entrepreneurship

Are you swimming in the red or blue ocean? Dominate your market through a “Blue Ocean” strategy

Dec 06 2023 · Consulting, Entrepreneurship

AI – an impending shift within the junior consulting profession

Nov 23 2023 · Consulting, Entrepreneurship

Being kind at work pays off

Aug 16 2023 · Consulting, Entrepreneurship

This is how you grow your consulting firm faster with ambassadors

Jul 05 2023 · Cinode, Consulting, Entrepreneurship

Succeed in the Nordic market as a Polish consulting firm

May 16 2023 · Consulting, Entrepreneurship

The consulting company that grows without growth goals

May 09 2023 · Consulting, Entrepreneurship

Quickly growing AI expert Silo AI is streamlining its processes with Cinode

Apr 28 2023 · Cinode News, Skills Management

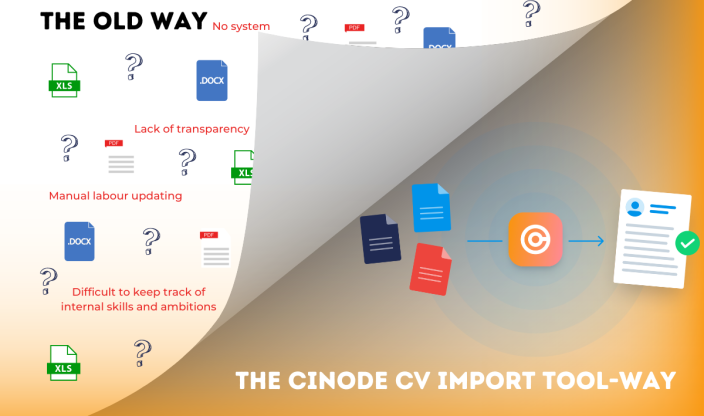

Easily create customized CVs with Cinode’s CV import tool

Apr 20 2023 · Consulting, Sales, Skills Management

How do you work more skills-based within your company?

Apr 04 2023 · Cinode News, Skills Management