Konsultkollen 2025: Growth Slows Significantly in the Swedish Consulting Sector

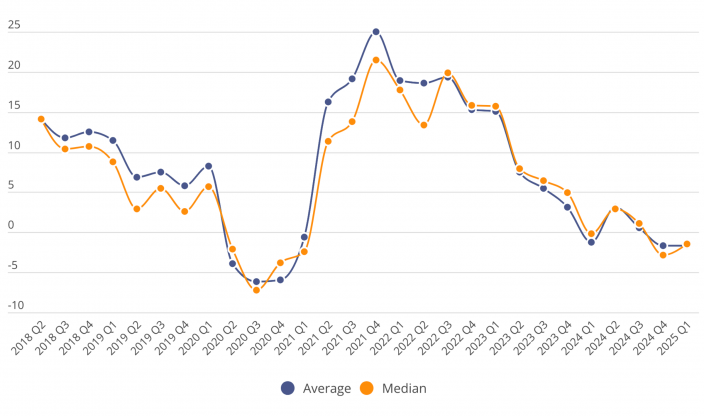

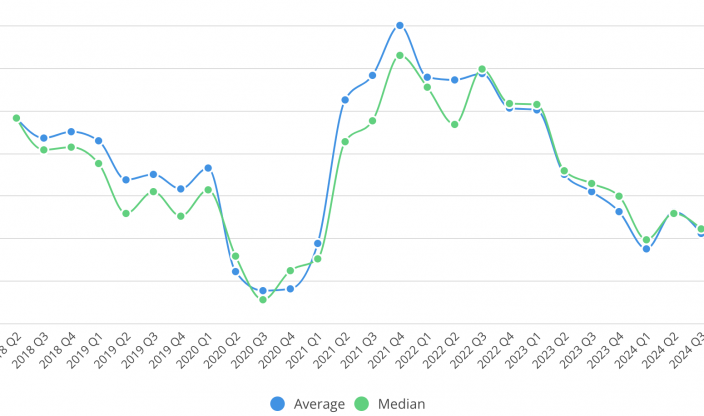

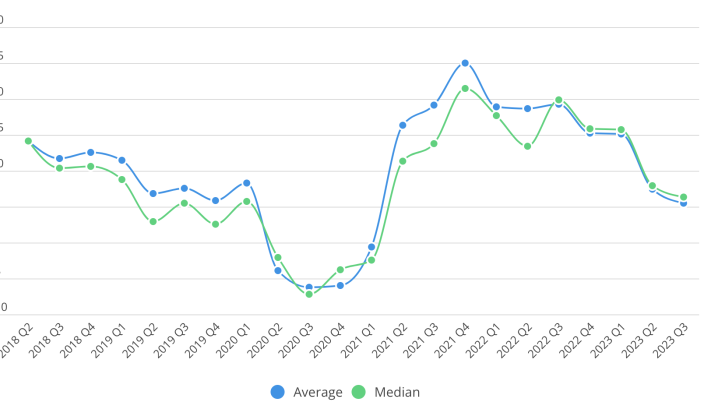

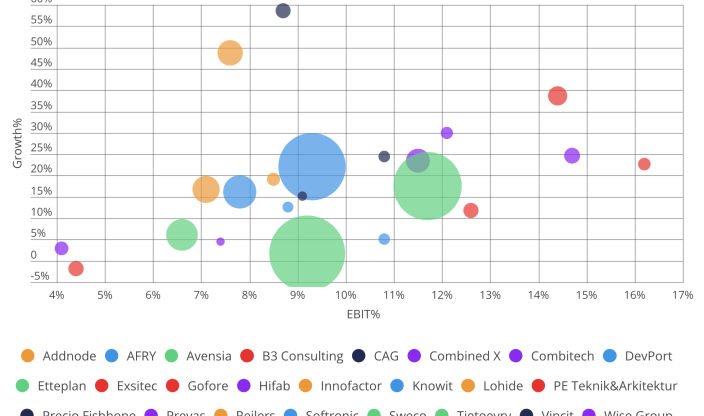

The Swedish consulting market has weakened throughout 2025. Growth in both revenue and headcount has fallen back to levels not seen in several years, while profitability continues to be under pressure. This is highlighted in Cinode’s annual Konsultkollen 2025 report, which analyzes data from more than 300 Swedish consulting firms.

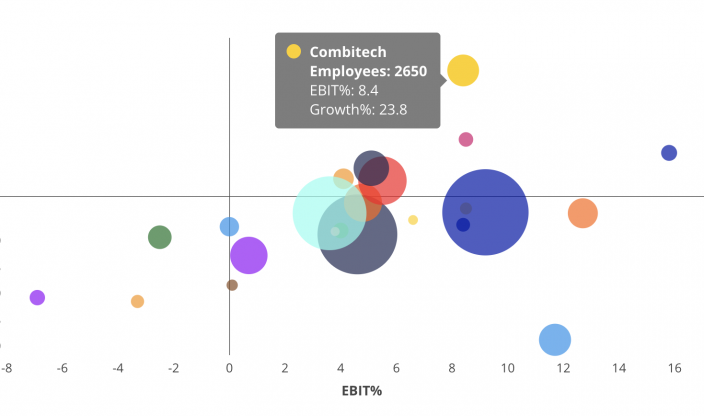

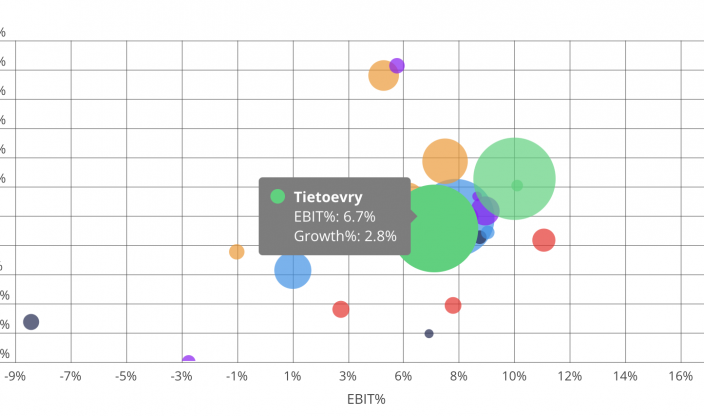

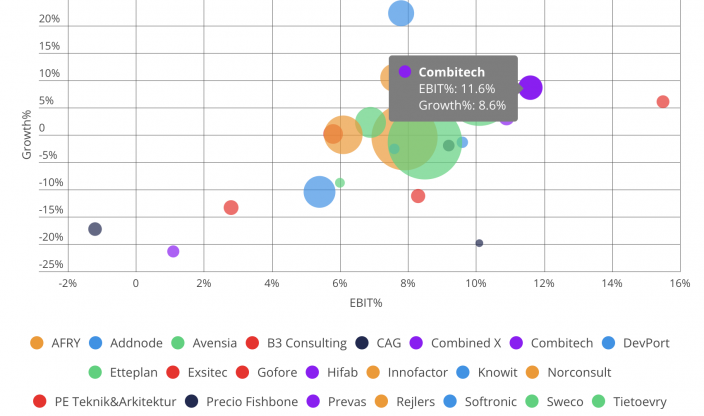

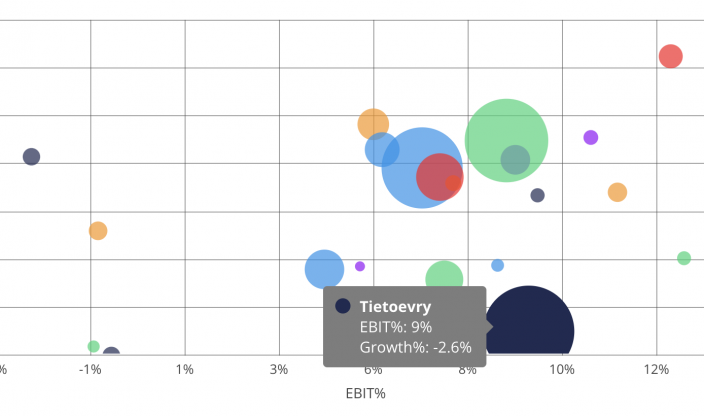

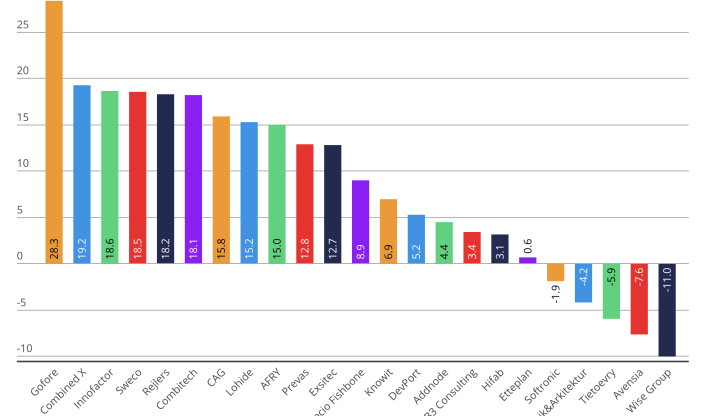

Average revenue growth has dropped to 2.6 percent, a sharp decline from 7.5 percent the previous year. Headcount growth is nearly flat at 0.7 percent, and operating margins have decreased to 4.4 percent. Many IT firms have had a particularly tough year, with several players exiting the market entirely.

– Following record-breaking years in 2021 and 2022, the Swedish consulting market has slowed significantly. We’re seeing declines in revenue growth, staffing, and profitability — back to levels we haven’t seen in a long time. The industry is becoming increasingly polarized — both in terms of skills and the sectors firms operate in. Several well-established players are struggling with growth and margins, while others have gone bankrupt or exited the market, says Mattias Loxi, Co-founder and CMO at Cinode.

Despite a challenging market, several firms are demonstrating that strong growth is still achievable. This year’s top performer is Aixia, reporting an impressive 232 percent increase in revenue. Triive ranks second with 192 percent revenue growth and also leads in headcount growth at 180 percent. Other high-growth companies include Altio Sweden, byBrick, Coody, Redeploy, and TechSeed — last year’s top performer.

The most profitable firms in this year’s report include Cleeven Sverige, Devcore, and McKinsey & Company.

Sector performance continues to diverge. Segments such as defense, energy, infrastructure, and cybersecurity remain resilient, while much of the IT and broader tech sector has faced a significantly more challenging year. M&A activity is also well below historical levels.

– The winners are those building attractive, learning-driven cultures, operating with efficiency, leveraging automation and AI, adapting their business models and pricing strategies, and targeting high-growth markets such as the energy transition, industrial transformation, and digitalization — with AI playing a central role. These are the firms best positioned to thrive when the market rebounds, says Mattias Loxi.

👉 Access the full analysis and all key figures in Konsultkollen 2025.

Mattias Loxi, Co-Founder / CMO

Mattias Loxi, Co-Founder / CMO

You may also like...

All posts

Aug 29 2025 · Economic Reports

Consulting Industry Faces Continued Decline in Q2 – Growth Slows, Margins Under Pressure

May 23 2025 · Economic Reports

Another weak quarter for the consulting firms with negative growth figures and lower margins

Mar 05 2025 · Economic Reports

Negative Growth and Declining Margins Among Consulting Firms

Nov 21 2024 · Economic Reports

Demand remains weak in the consulting industry

Aug 23 2024 · Economic Reports

Consulting firms continue to face challenges in the second quarter

May 21 2024 · Economic Reports

Negative Growth Among Consulting Firms in the First Quarter

Mar 05 2024 · Economic Reports

Tough 2023 for the Nordic Consulting Industry

Nov 29 2023 · Economic Reports

2023 Q3 – Challenging Swedish and Finnish consulting market

Sep 19 2023 · Economic Reports

Slowdown in the diversified consulting market

May 17 2023 · Economic Reports

Q1 2023 – Growth continues in the consulting industry

Apr 20 2023 · Consulting, Sales, Skills Management

How do you work more skills-based within your company?

Mar 23 2023 · Consulting, Sales, Skills Management