Slowdown in the diversified consulting market

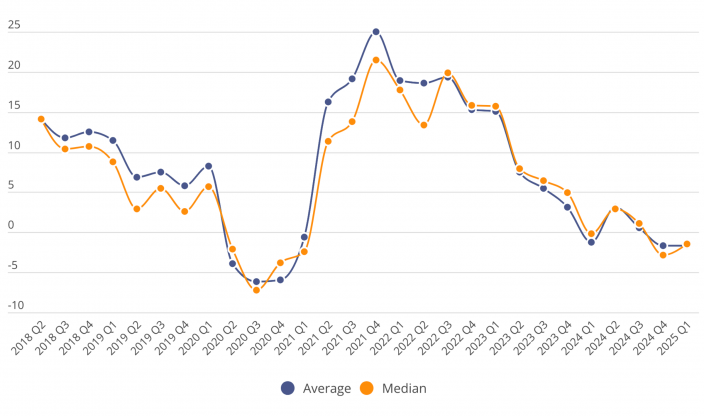

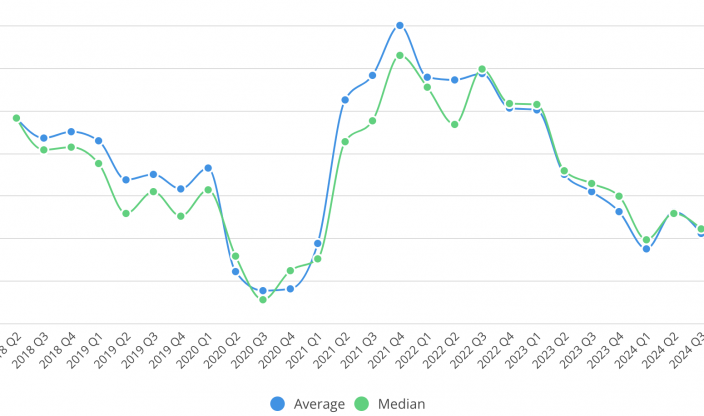

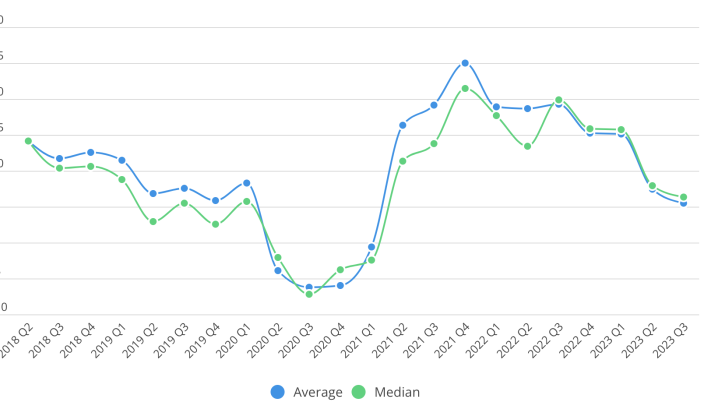

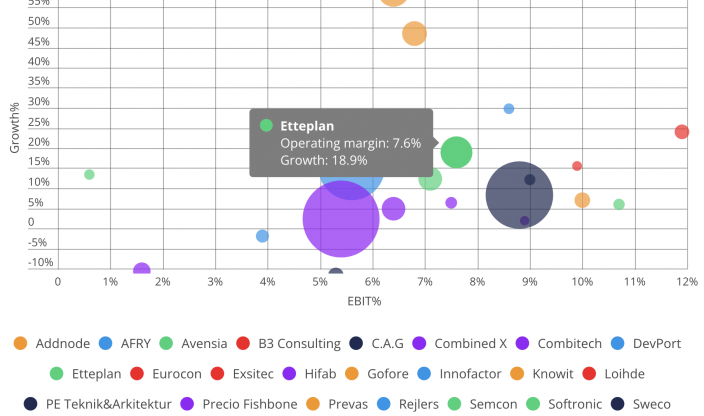

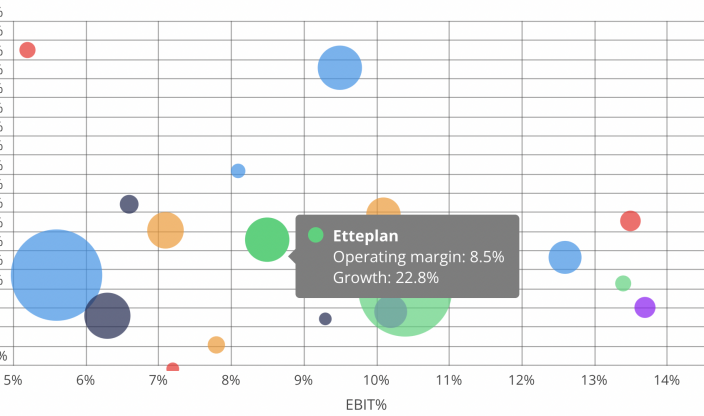

The slowdown in the Swedish and Finnish consulting industry is now beginning to impact the companies’ figures. Growth is generally weak, and the operating margin has significantly declined. However, one less working day has a negative impact on the figures.

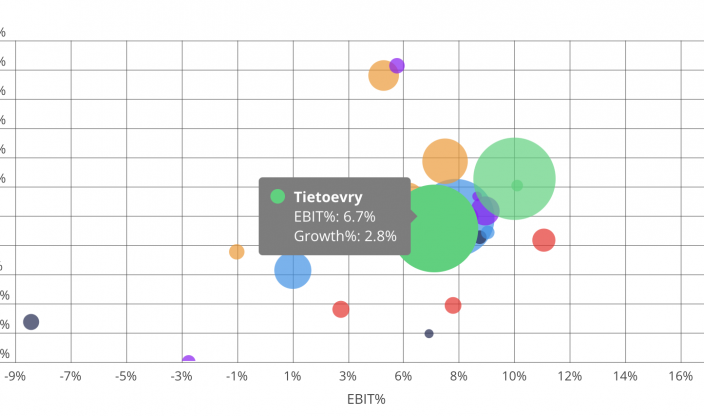

However, this is not a complete picture we are seeing but a highly differentiated market. Some companies and sectors continue to perform strongly. IT-heavy companies, which previously had strong tailwinds, have faced considerably tougher times. Real estate, retail, and HR have also encountered significant challenges.

Cybersecurity/defense and industrial- and energy-related sectors have performed very well, and public investments remain at a stable level.

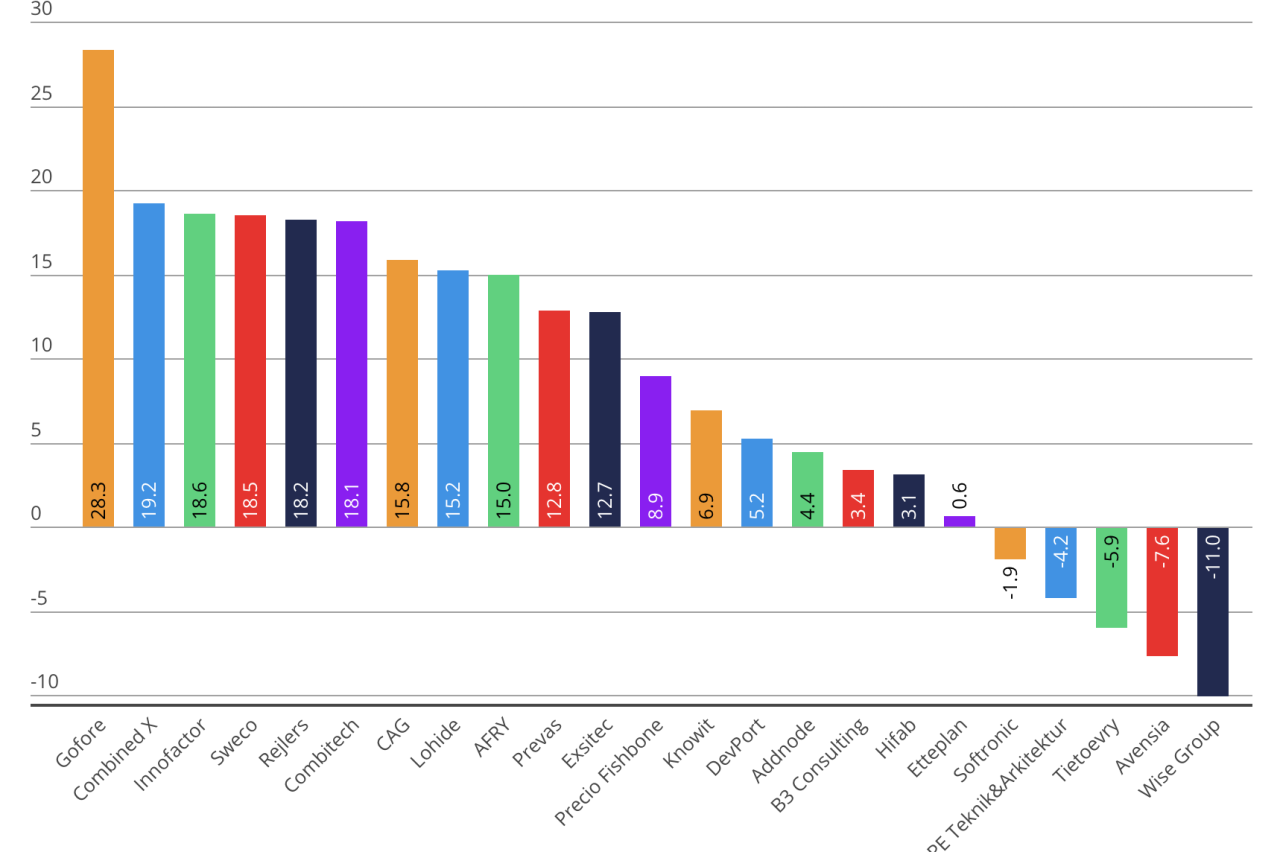

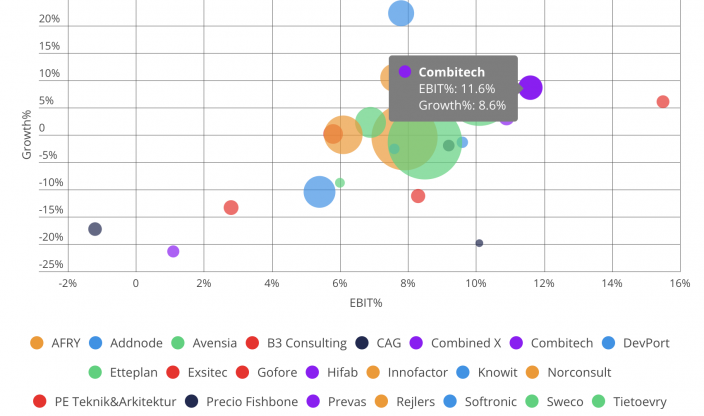

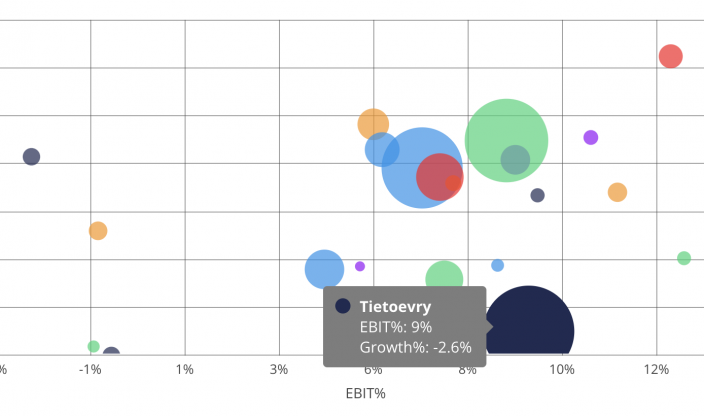

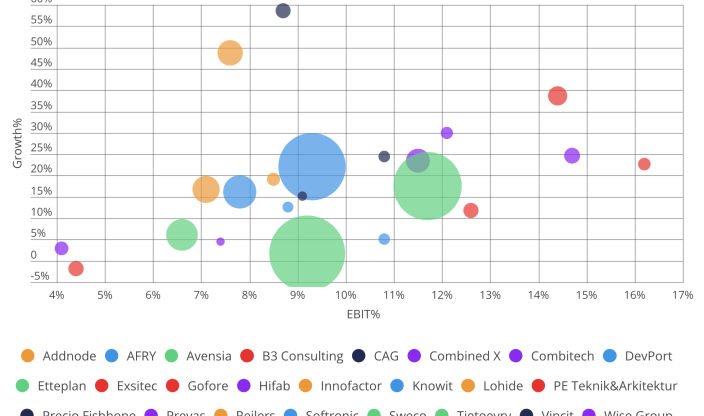

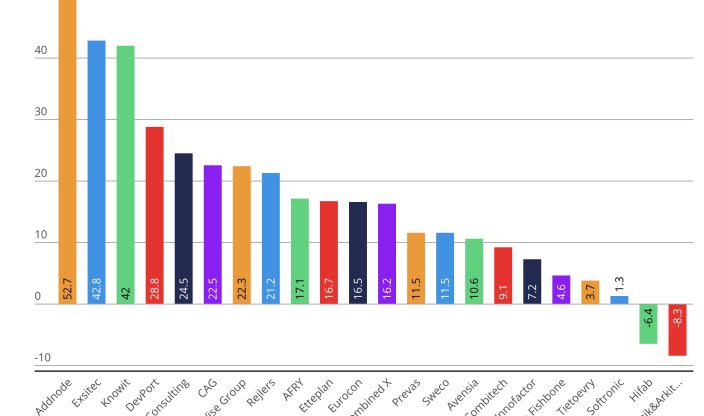

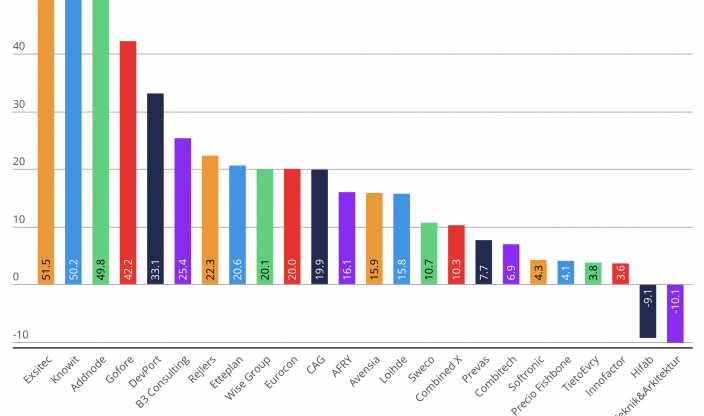

The growth has slowed down significantly and averaged 7.5 percent during the quarter, which is lower than inflation. Just one quarter ago, it was over 15 percent. Another reason for the growth slowdown is that we have seen far fewer acquisitions recently, which is also a sign of market slowdown. The companies with the highest growth during the quarter were Gofore, Combined X and Innofactor.

In terms of margins, three-quarters of the companies have lower margins compared to the previous year. The quarter shows lower utilization rates, but there is also one less working day compared to the previous year. Exsitec, Combined X, and Gofore have the highest margins.

Half of the companies have fewer employees at the end of the quarter compared to the beginning. Many companies report fewer layoffs and more cautious hiring, combined with fewer acquisitions. Rejlers, Sweco, and Innofactor have seen the most growth in the number of employees.”

Mattias Loxi, Co-Founder / CMO

Mattias Loxi, Co-Founder / CMO

You may also like...

All posts

May 23 2025 · Economic Reports

Another weak quarter for the consulting firms with negative growth figures and lower margins

Mar 05 2025 · Economic Reports

Negative Growth and Declining Margins Among Consulting Firms

Nov 21 2024 · Economic Reports

Demand remains weak in the consulting industry

Aug 23 2024 · Economic Reports

Consulting firms continue to face challenges in the second quarter

May 21 2024 · Economic Reports

Negative Growth Among Consulting Firms in the First Quarter

Mar 05 2024 · Economic Reports

Tough 2023 for the Nordic Consulting Industry

Nov 29 2023 · Economic Reports

2023 Q3 – Challenging Swedish and Finnish consulting market

May 17 2023 · Economic Reports

Q1 2023 – Growth continues in the consulting industry

Mar 17 2023 · Economic Reports

High growth and good margins for consulting firms in Sweden and Finland

Dec 01 2022 · Economic Reports

Q3 – Consulting companies remain strong

Sep 21 2022 · Economic Reports

2022 Q2 – Despite war and inflation, the consultancy industry continues to grow

May 30 2022 · Economic Reports