Consulting industry remains challenged in Q3 – but more firms are growing and signs point to recovery

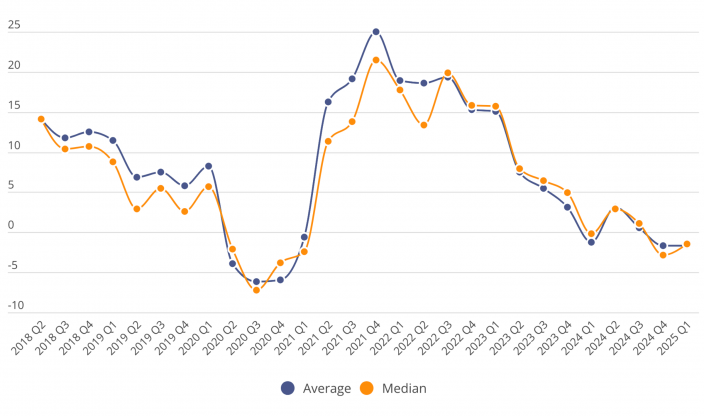

The latest quarter shows the first indications that the consulting industry may be starting to leave its most difficult period behind. A new summary from Cinode reveals that more than half of the listed consulting firms increased their headcount during the quarter – something that has not happened in the past two years.

“After several years of consecutive declines, we are now seeing for the first time that the majority of firms are actually growing within a single quarter. It’s a clear turning point and a strong signal that the market may have reached bottom,” says Mattias Loxi, Co-founder of Cinode.

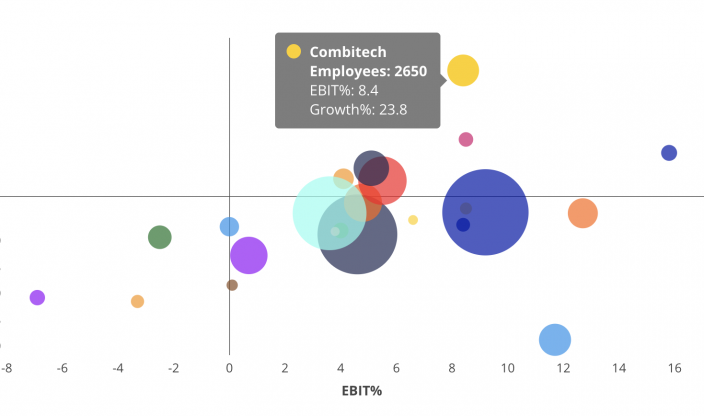

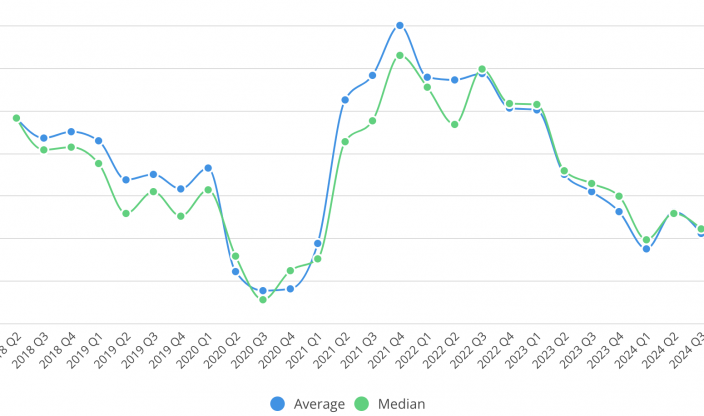

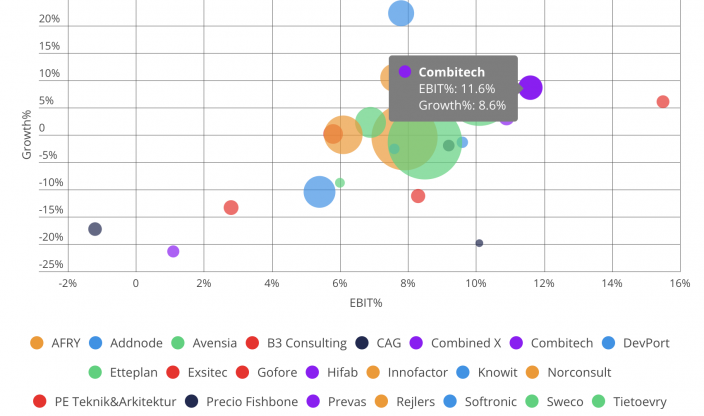

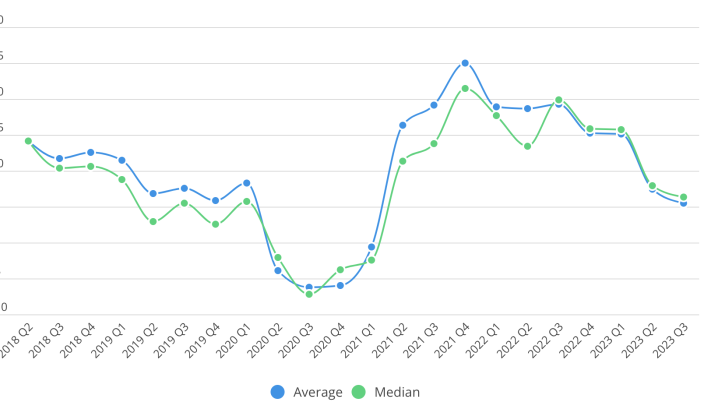

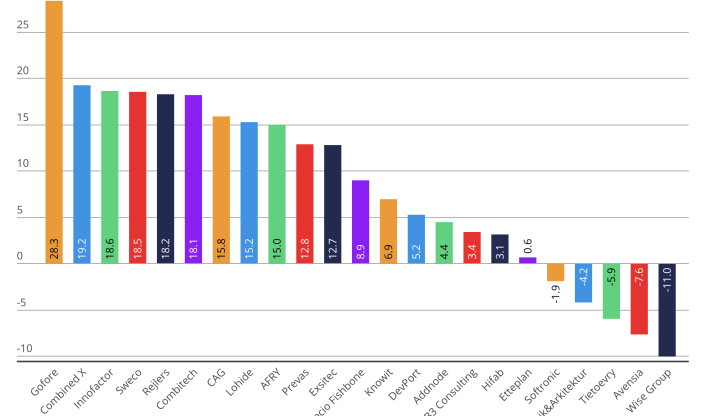

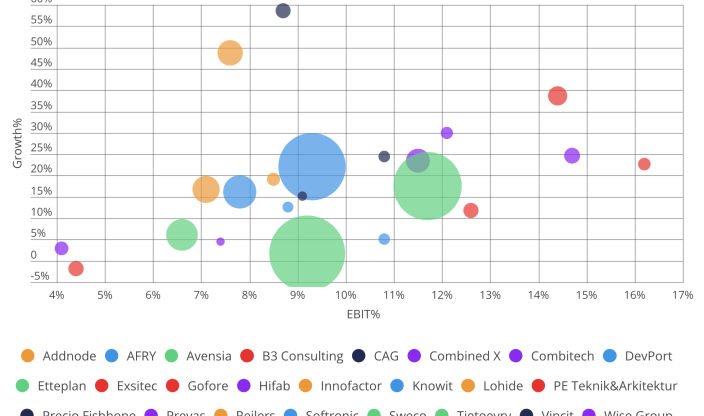

More than half of the firms also reported positive revenue growth compared to the same quarter last year – something not seen since Q3 2024. The median growth rate reached +0.9 percent, while the average growth remains slightly negative at –1.6 percent. Differences between sectors are significant: infrastructure, energy, and defense continue to show strong momentum, while firms focused on automotive, real estate, and the public sector report a more subdued development. The strongest growth this quarter came from Combitech, Exsitec, and Norconsult.

Turning point in headcount

After two years of continuous staff reductions, more than half of consulting firms now have a higher number of employees at the end of the quarter compared to the beginning. M&A activity has also picked up. Gofore and Addnode reported the largest increases in staff numbers, primarily driven by acquisitions.

However, several challenges remain. On an annual basis, a majority of firms still have fewer employees than at the start of the year. Growth in both headcount and revenue remains modest for many, indicating that the recovery is still fragile.

“We’re seeing greater optimism in company reports, with signs of more stable utilization and growing demand. Among our own customers, there’s also a stronger sense of confidence. One of the most positive signals is that headcount is starting to rise again in many firms, and M&A activity is gaining momentum. Hopefully, we’ll see even clearer signs of improvement in the coming quarters,” Loxi continues.

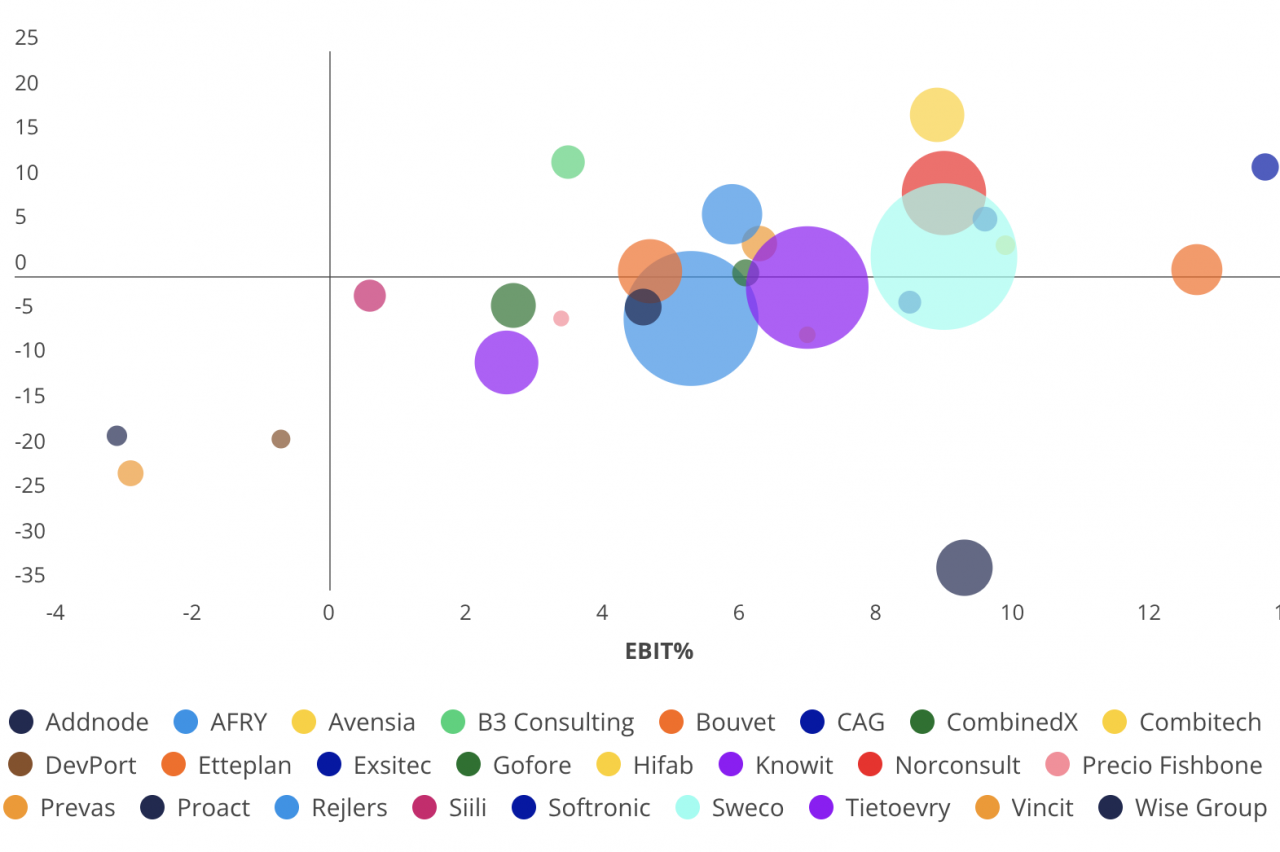

Profitability remains at similar levels

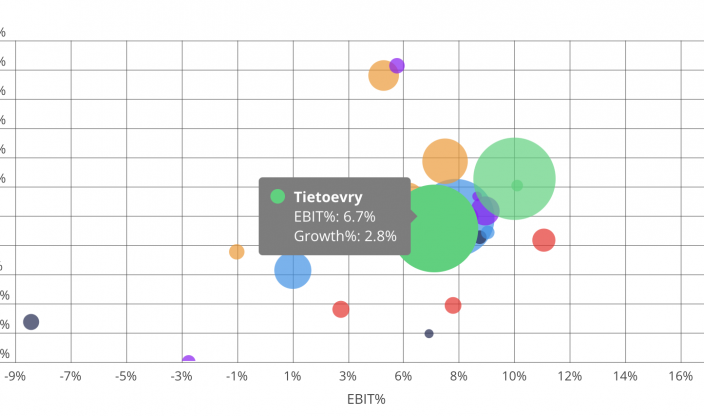

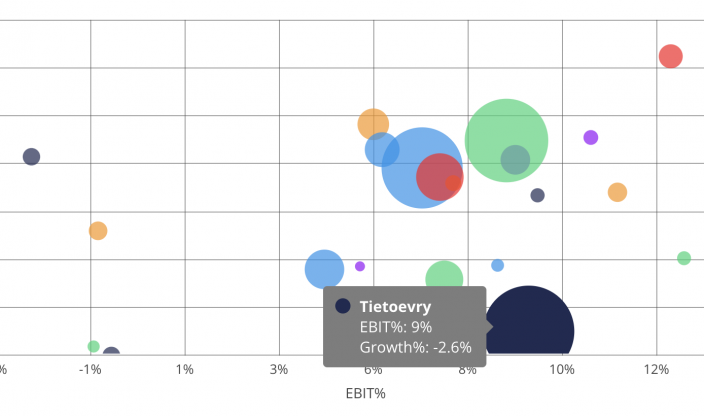

Profitability remains roughly in line with the previous year. About half of the firms improved their margins, while the other half saw declines. The average EBIT margin ended at 4.4 percent (4.5), and the median at 5.1 percent (5.1). Tietoevry, Softronic, and Bouvet reported the strongest margins in the quarter.

Mattias Loxi, Co-Founder / CMO

Mattias Loxi, Co-Founder / CMO

You may also like...

All posts

Oct 15 2025 · Economic Reports, Sales

Konsultkollen 2025: Growth Slows Significantly in the Swedish Consulting Sector

Aug 29 2025 · Economic Reports

Consulting Industry Faces Continued Decline in Q2 – Growth Slows, Margins Under Pressure

May 23 2025 · Economic Reports

Another weak quarter for the consulting firms with negative growth figures and lower margins

May 16 2025 · Cinode, Uncategorized

From Teamtailor to Matched and Presented Consultant in Cinode – in Just a Few Seconds!

Mar 05 2025 · Economic Reports

Negative Growth and Declining Margins Among Consulting Firms

Nov 21 2024 · Economic Reports

Demand remains weak in the consulting industry

Aug 23 2024 · Economic Reports

Consulting firms continue to face challenges in the second quarter

May 21 2024 · Economic Reports

Negative Growth Among Consulting Firms in the First Quarter

Mar 05 2024 · Economic Reports

Tough 2023 for the Nordic Consulting Industry

Nov 29 2023 · Economic Reports

2023 Q3 – Challenging Swedish and Finnish consulting market

Sep 19 2023 · Economic Reports

Slowdown in the diversified consulting market

May 17 2023 · Economic Reports