Another weak quarter for the consulting firms with negative growth figures and lower margins

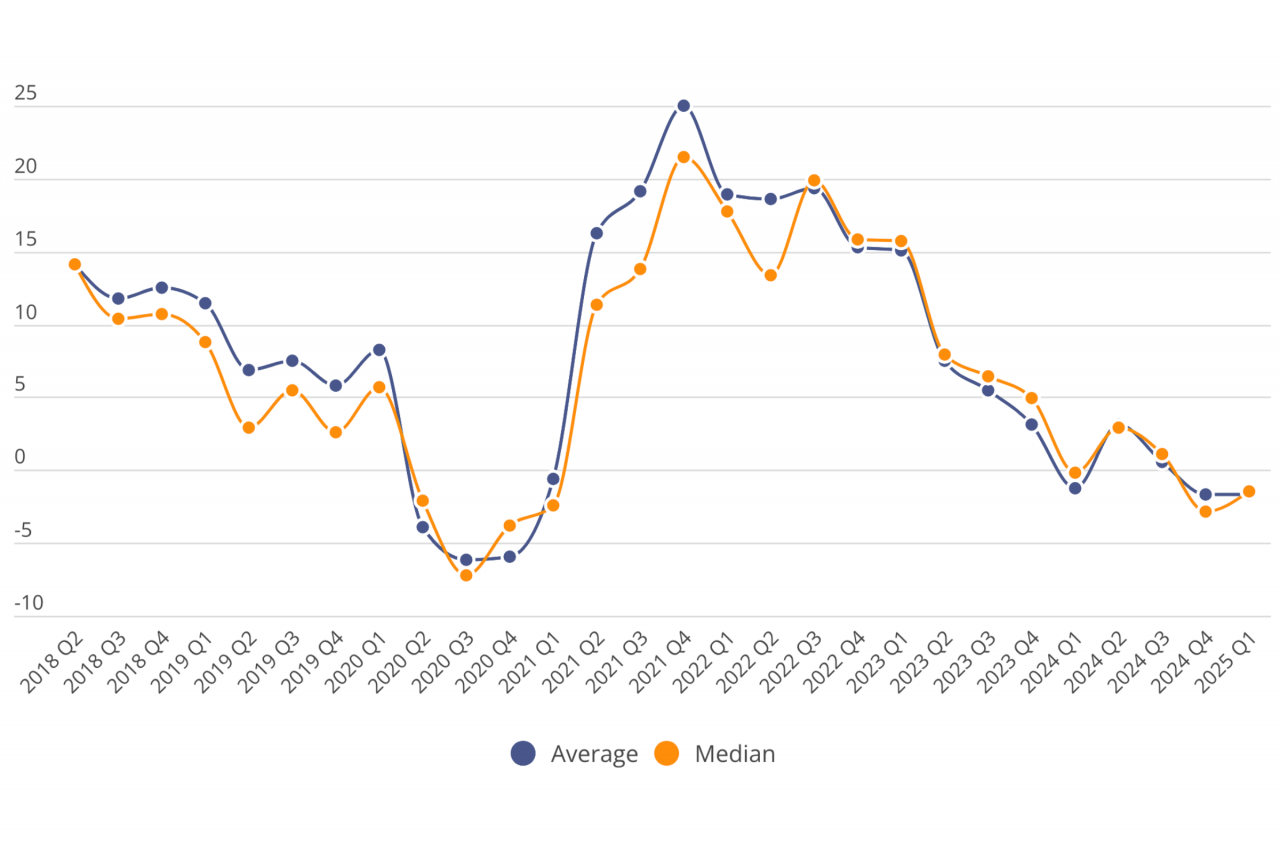

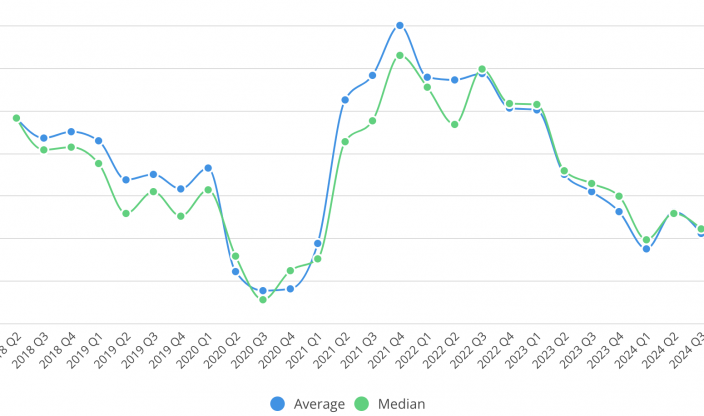

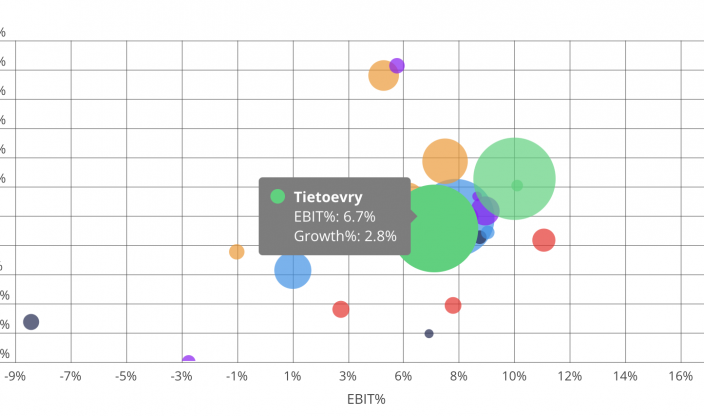

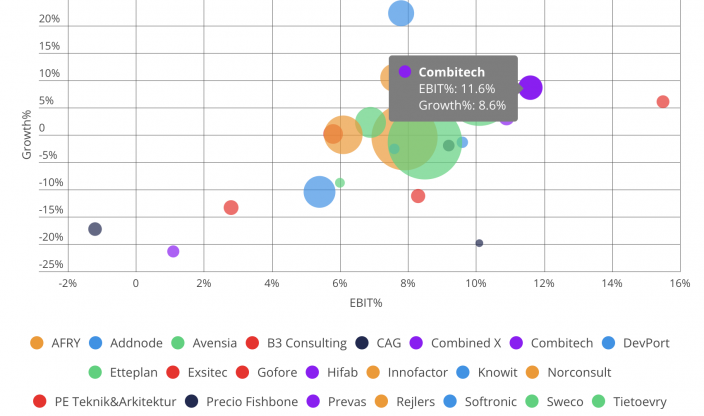

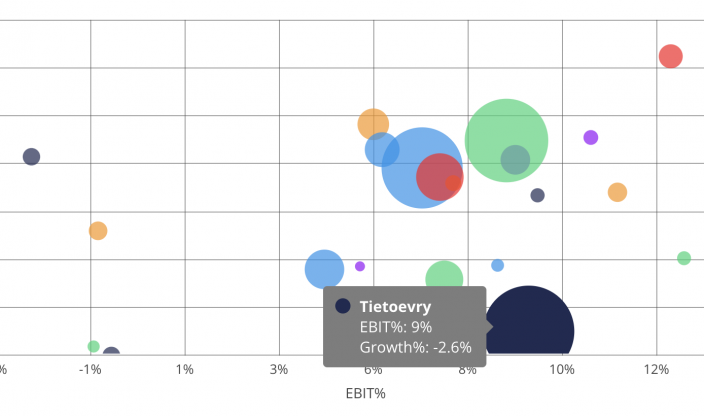

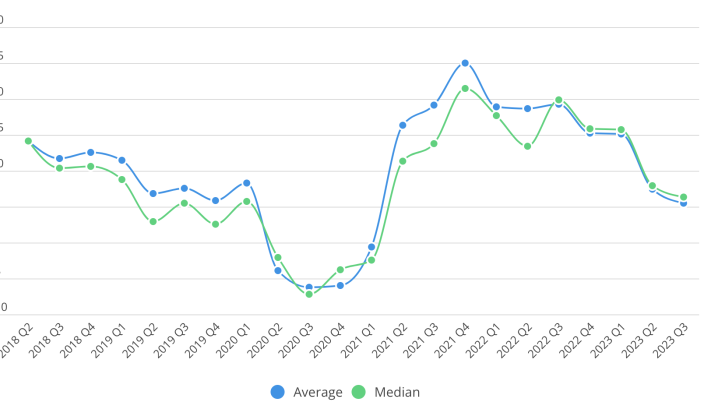

The publicly listed consulting firms in Sweden, Finland and Norway continue to face headwinds in the first quarter of the year. According to Cinode’s summary of the Q1 reports, the majority of the companies are showing negative growth and declining operating margins.

– Two-thirds of the companies report weaker margins compared to the same period last year. IT consultants have had the toughest time, while players in energy, defense, cybersecurity, and parts of the industrial sector are still experiencing strong demand, says Mattias Loxi, co-founder of Cinode – the Nordic region’s leading SaaS platform for consulting companies.

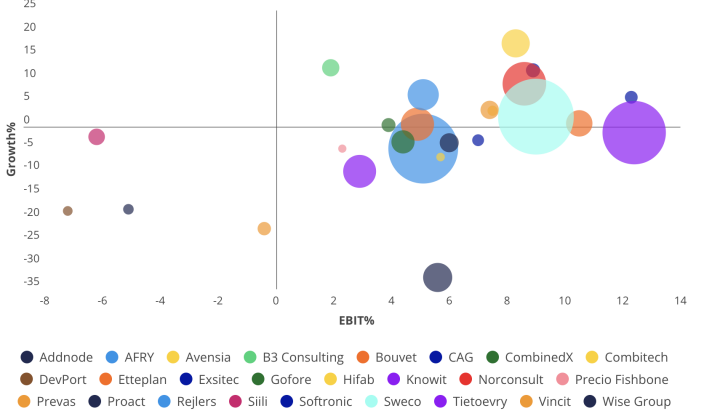

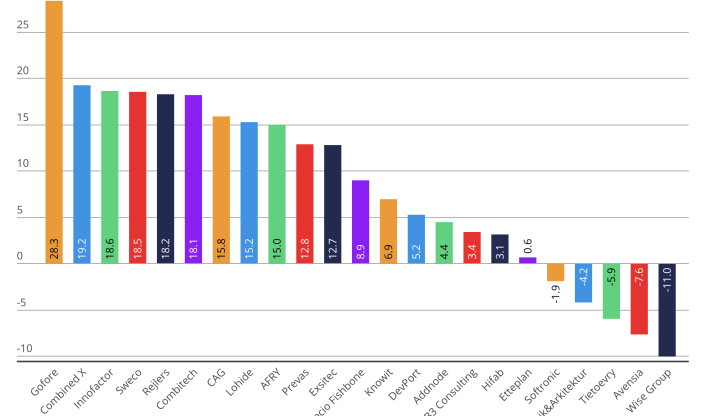

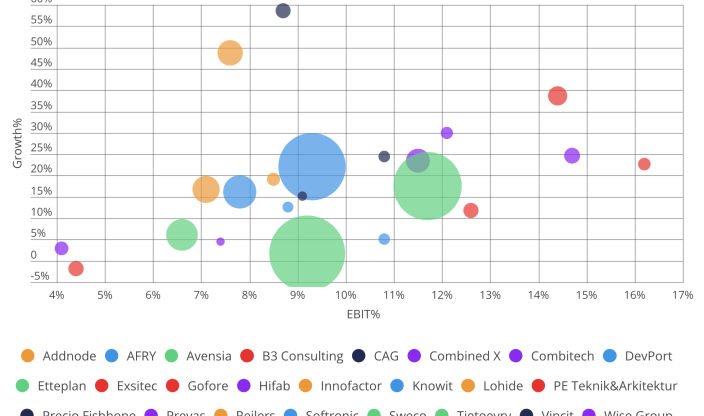

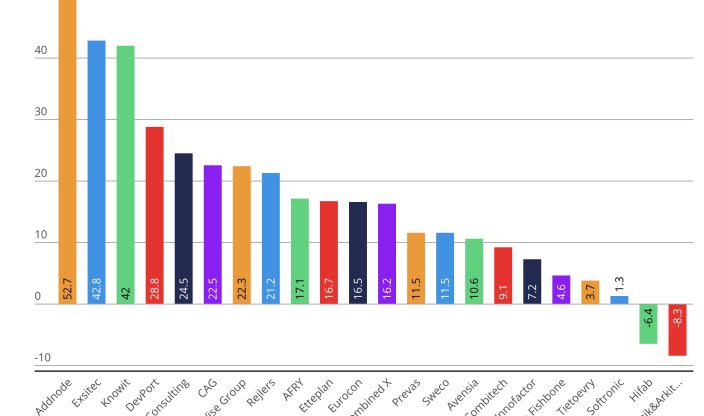

The workforce has decreased at seven out of ten companies since the beginning of the year, reflecting the continued weakness in the market. Operating margins have also weakened, with an average EBIT margin of 7.3 percent—down from 8.0 percent in the same quarter of 2024. The highest margins were reported by Exsitec, Bouvet, and Avensia.

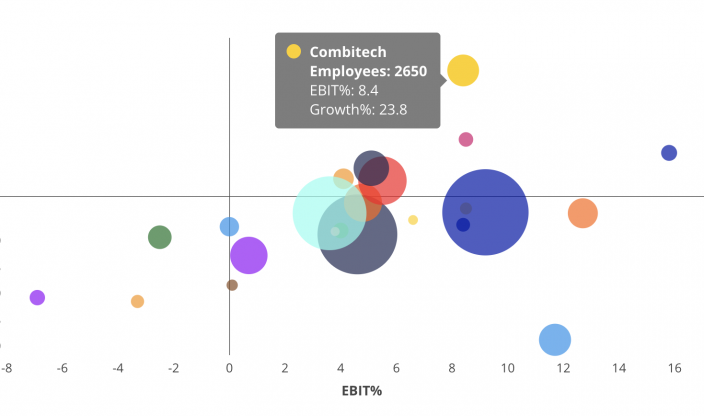

Growth is also declining. On average, the companies have contracted by 1.7 percent, compared to -0.1 percent a year ago. However, Avensia, B3 Consulting, and defense-focused Combitech are positive exceptions, showing the strongest growth.

– Consulting firms continue to streamline and adjust their costs in response to market conditions. At the same time, we are seeing a clear connection this year between growth and operating margins—something that has been weaker in the past. This suggests that companies that are growing are also managing to maintain or even improve their profitability, says Mattias Loxi.

Mattias Loxi, Co-Founder / CMO

Mattias Loxi, Co-Founder / CMO

You may also like...

All posts

Nov 16 2025 · Economic Reports

Consulting industry remains challenged in Q3 – but more firms are growing and signs point to recovery

Oct 15 2025 · Economic Reports, Sales

Konsultkollen 2025: Growth Slows Significantly in the Swedish Consulting Sector

Aug 29 2025 · Economic Reports

Consulting Industry Faces Continued Decline in Q2 – Growth Slows, Margins Under Pressure

Mar 05 2025 · Economic Reports

Negative Growth and Declining Margins Among Consulting Firms

Nov 21 2024 · Economic Reports

Demand remains weak in the consulting industry

Aug 23 2024 · Economic Reports

Consulting firms continue to face challenges in the second quarter

May 21 2024 · Economic Reports

Negative Growth Among Consulting Firms in the First Quarter

Mar 05 2024 · Economic Reports

Tough 2023 for the Nordic Consulting Industry

Nov 29 2023 · Economic Reports

2023 Q3 – Challenging Swedish and Finnish consulting market

Sep 19 2023 · Economic Reports

Slowdown in the diversified consulting market

May 17 2023 · Economic Reports

Q1 2023 – Growth continues in the consulting industry

Mar 17 2023 · Economic Reports