Negative Growth and Declining Margins Among Consulting Firms

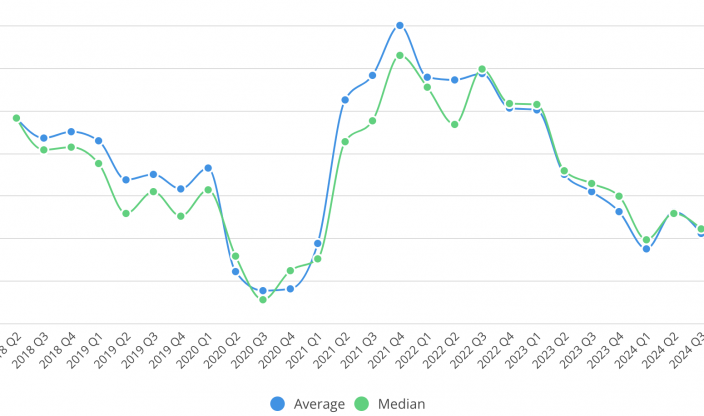

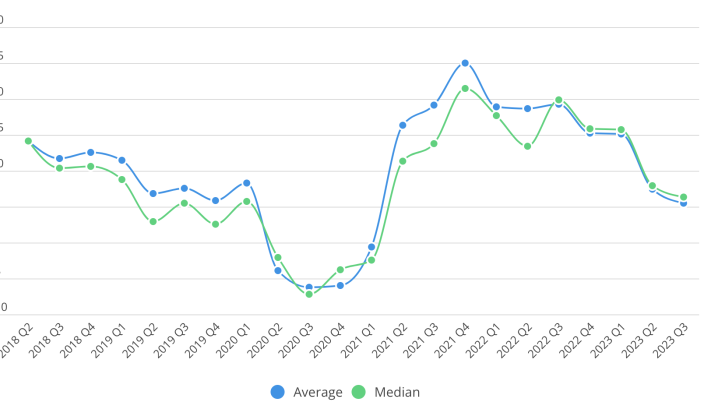

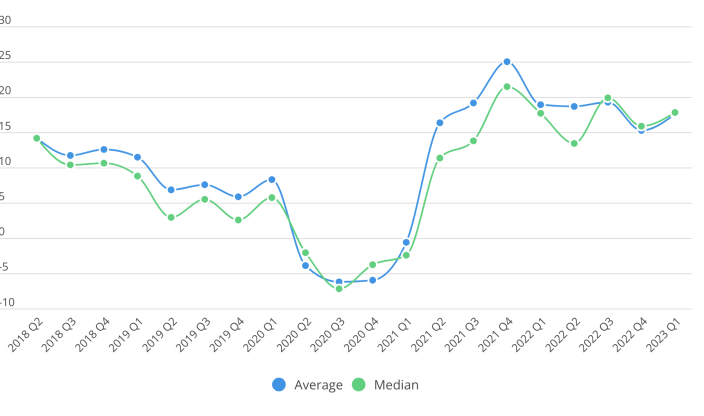

Publicly listed consulting firms in Sweden and Finland faced a challenging 2024, experiencing declining margins and negative growth over multiple quarters. The fourth quarter marked the second quarter of the year with negative growth, with both average and median growth rates falling below zero.

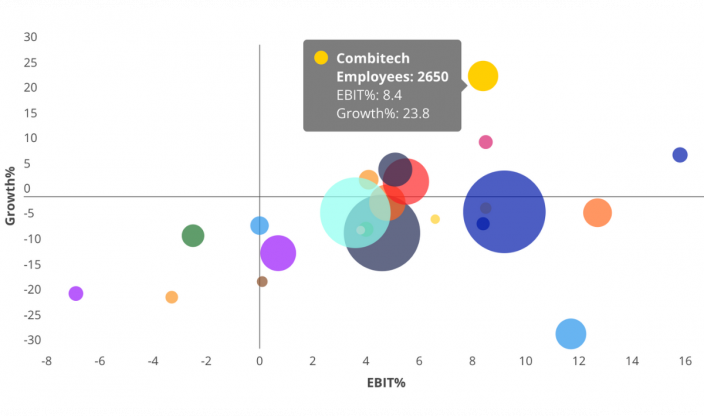

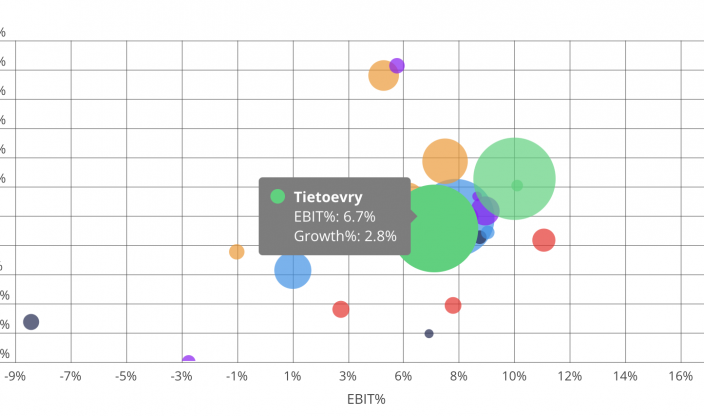

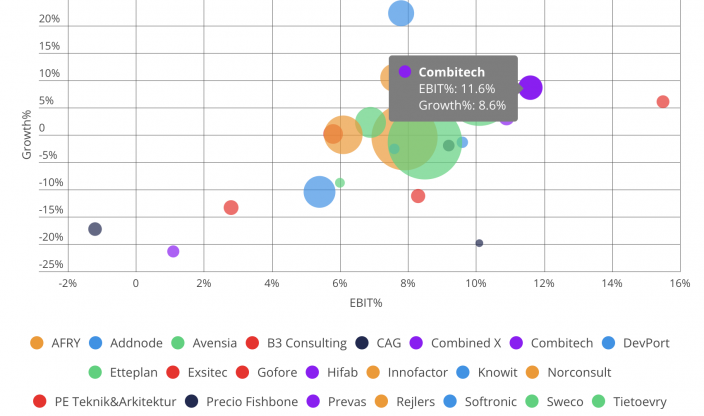

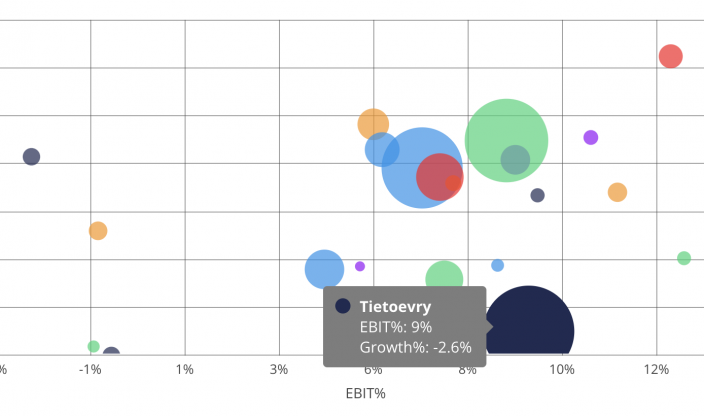

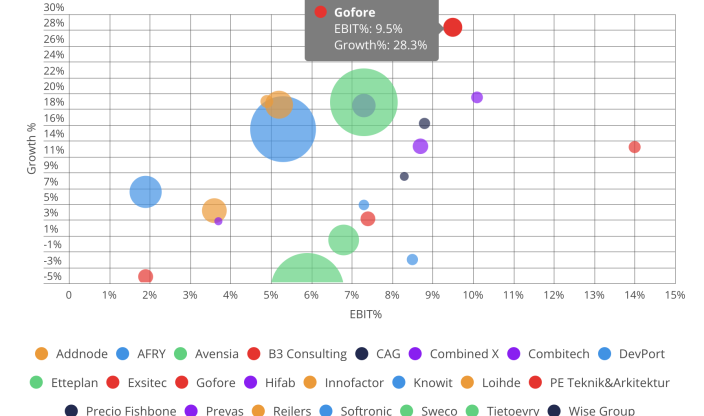

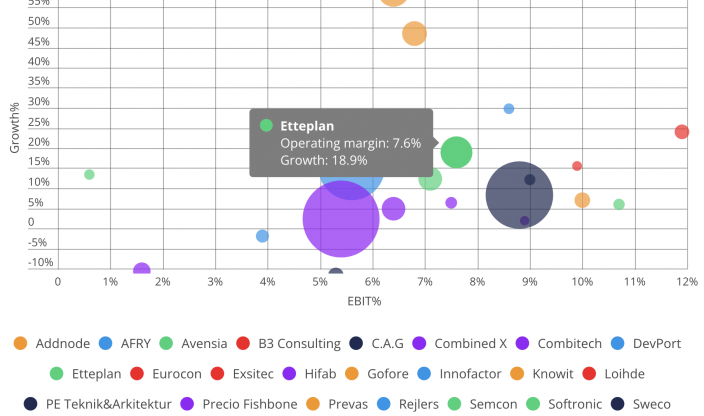

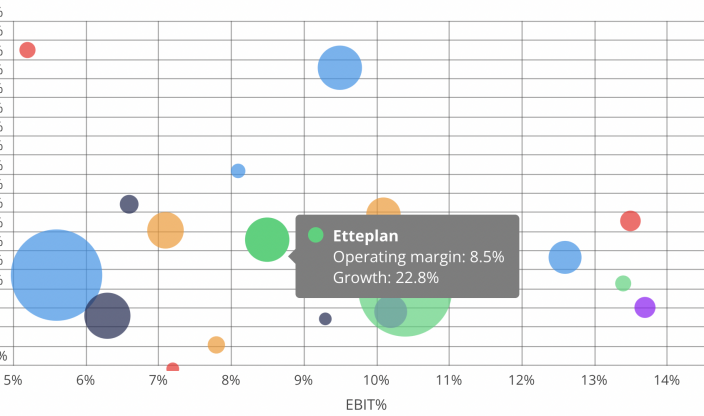

At the same time, differences among companies are evident—technical consulting firms have continued to grow, both through acquisitions and organic expansion, while others have had to reduce their workforce and adjust to a weaker market.

“Two-thirds of consulting firms saw their margins decline in Q4 compared to last year. The weak economic climate is the primary reason, but fewer working days and increased vacation leave have also had a negative impact. IT consulting firms have been hit the hardest, and the previous interpretation of the rental law has further contributed to the challenges,” says Mattias Loxi, co-founder of Cinode.

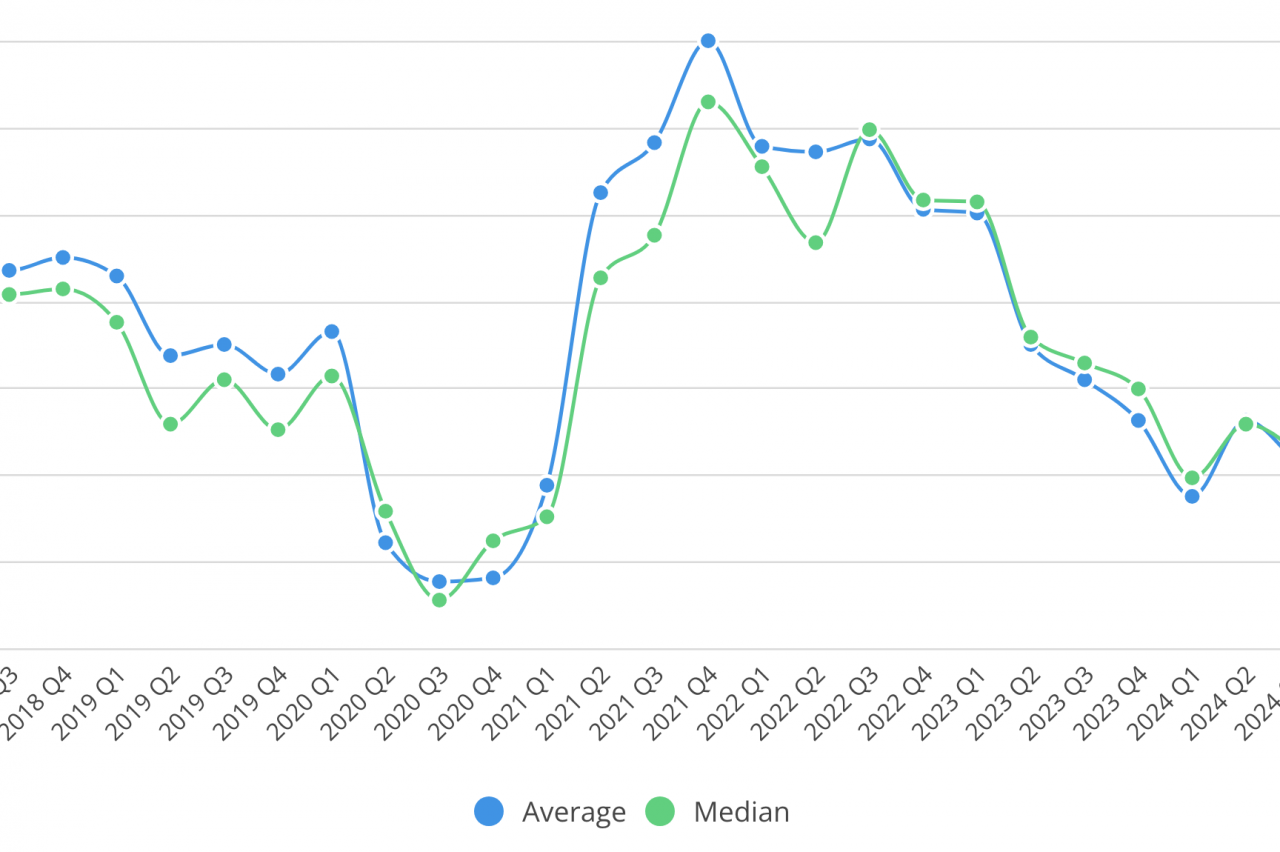

Margins Are Falling

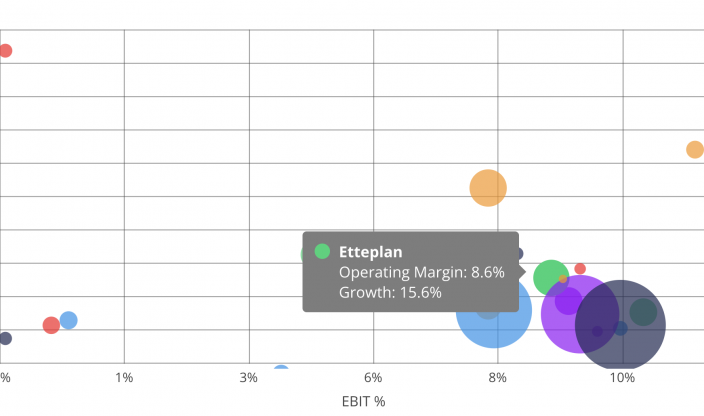

The average margin dropped to 7.2% (8.0%) in Q4, with the median declining to 6.5% (8.1%). For the full year, the average operating margin fell to 6.4% (6.7%), while the median decreased to 6.8% (7.2%).

“We see a clear trend of profitability being squeezed, but many firms have still managed to navigate the economic downturn relatively well through cost savings. This is different from previous recessions, where we saw more dramatic margin declines,” Loxi continues.

Growth Near Zero for the Full Year

The fourth quarter recorded an average negative growth rate of -1.6% (3.1%) and a median of -2.8% (4.9%). For the full year, growth was almost flat, with a median of 0.6% and an average growth rate of -0.1%.

“For the full year, we see that growth has essentially stalled, though some firms have still expanded through strategic acquisitions. However, organic growth is even more negative across the industry,” says Loxi.

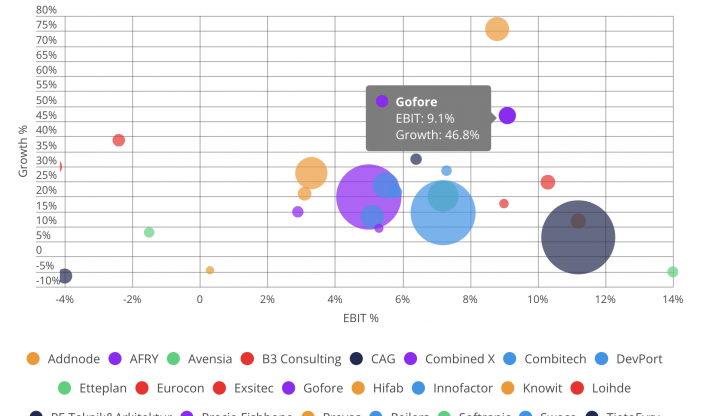

B3 Consulting, Exsitec, CombinedX, and Prevas were among the consulting firms that grew the most in 2024, with acquisitions playing a crucial role in their expansion.

Consulting Firms Continue to Streamline Operations

More than half of consulting firms reduced their number of employees in Q4 compared to Q3. Over the full year, nearly half of the firms have cut their workforce.

“Consulting firms continue to optimize and adjust their costs in response to market changes. The strongest firms are those with a clear niche expertise and the ability to adapt their delivery model to customers’ evolving needs,” Loxi concludes.

Mattias Loxi - Perustaja - Myynti - Markkinointi

Mattias Loxi - Perustaja - Myynti - Markkinointi

Saatat pitää myös...

Kaikki viestit

elo 29 2025 · Taloudelliset raportit

Consulting Industry Faces Continued Decline in Q2 – Growth Slows, Margins Under Pressure

marras 21 2024 · Taloudelliset raportit

Demand remains weak in the Finnish and Swedish consulting industry

elo 24 2024 · Taloudelliset raportit

Consulting firms continue to face challenges in the second quarter

touko 21 2024 · Taloudelliset raportit

Negative Growth Among Consulting Firms in the First Quarter

maalis 05 2024 · Taloudelliset raportit

Tough 2023 for the Nordic Consulting Industry

marras 29 2023 · konsultti, Taloudelliset raportit

2023 Q3 – Haastava konsulttimarkkina

syys 19 2023 · Taloudelliset raportit

Hidastumista jakaantuneessa konsultointimarkkinassa

kesä 07 2023 · Taloudelliset raportit

Q1 2023 – Kasvu jatkuu konsultointialalla

joulu 01 2022 · Taloudelliset raportit

Q3 Konsulttiyritysten kasvu jatkuu vahvana

syys 21 2022 · Taloudelliset raportit

2022 Q2 – Sodasta ja inflaatiosta huolimatta konsulttiala jatkaa kasvuaan

kesä 02 2022 · Taloudelliset raportit

2022 Q1 – Ennätysmarginaalit ja -kasvu konsultointialalla

huhti 21 2022 · Taloudelliset raportit